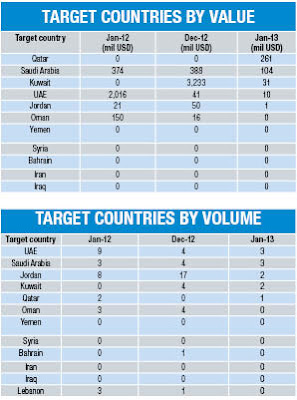

DOHA: Qatar has topped in the Merger and Acquisitions (M&A) activity targeting companies in the Middle East in January 2013. The month’s top transaction was a rights issue by Al Meera in which it will sell a 50 percent shareholding for almost $261m (QR950m), according to a new report by global deal data provider Zephyr.

The second highest-value deal was valued at less than half the Qatari transaction - purchase of a 13 percent stake in Saudi Arabia-based cement producer Najran valued at $104m.Together, these deals represented 90 percent of the total transaction value in the month under review.

However, mergers and acquisitions (M&A) activity targeting companies in the Middle East, dropped in January, with volume and value both plummeting. There were no deals valued at $1bn or over in January.

Though Qatar topped the value table, it fell behind on volume. This was entirely due to the single deal. Nevertheless, this still compares well with December, when no deals were recorded.

While the UAE and Saudi Arabia were both placed first by volume, with three deals apiece, the latter was ranked second by value with $104m and the former fourth with $10m. Kuwait took third place by value, attracting $31m of investment. The country was placed joint second with Jordan by volume, both firms having targets in two deals in December.

In total, just $406m was injected across 11 deals, an 89 percent decline in value from December 2012, and down 85 percent on a year ago.

No comments:

Post a Comment